In a world of precious metals that invest, gold has long been the beloved of investors seeking stability and wealth preservation. However, knowledgeable investors are increasingly turning their attention to a compelling silver investment opportunity – often called “the forgotten metal” – as a potentially more lucrative opportunity under today’s market conditions. While gold continues to make headlines with its stable performance, Silver’s time to shine can finally come.

Silver Investment Opportunity: A Well -Tested Pattern of Following – Then Exceeding – Gold

During periods of improvement and monetary uncertainty, Silver has a habit of following Gold’s Rise – only eventually surpassing it. After the covid accident in 2020, gold increased 8%, while Silver rocketed 73%. After the financial crisis in 2008, Silver increased 81% compared to Gold’s 44%.

Why the delayed dynamic dynamic? It comes down to Silver’s unique role in the global economy.

Unlike gold, which is primarily a monetary metal, Silver stretches two worlds: it is both a store with value and an important industrial resource.

The industrial engine behind Silver’s strength

Silver’s growing use in technology and green energy makes it an increasingly attractive silver investment opportunity in the modern economy. This industrial tool creates a basic support system for silver that gold simply does not have.

- Renewable energy: Silver is essential for the production of solar energy, where each photovoltaic panel contains about 20 grams of metal. As governments and businesses around the world increase interest rate energy initiatives, the demand for silver in solar panels is expected to wave.

- Electronics and technology: From smartphones to electric vehicles, Silver’s unmatched conductivity makes the basics of electronics production. As the global technological adoption expands, baseline also makes the demand for silver – an underlying force independent of investor mood.

- Medical applications: Silver’s antimicrobial properties have led to increasing use in medical devices, bandages and even the hospital’s air filtering systems. The pandemic highlighted these properties, and demand has only grown in its wake.

These industrial drivers not only expand Silver’s demand base – they help support prices, even in unstable markets. According to Marketwatch, whose industrial consumption continues to rise while the supply remains limited, silver could see significant price winds in the coming years.

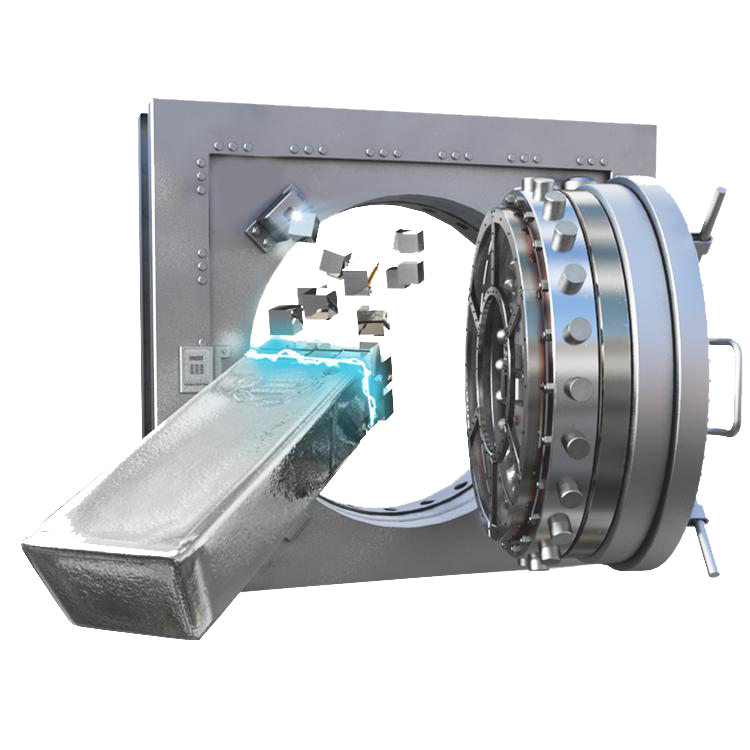

Instavault Silver – (1 Troy Oz -Trin)

As low as: $ 34.13

Invest now

1 OZ American Silver Eagle Coin

As low as: $ 37.34

Invest now

100 oz silver bar – different mint

As low as: $ 3387.68

Invest now

1 oz Canadian silver maple leaf coin

As low as: $ 35.46

Invest now

Supply Restrictions: The overlooked silver deficiency

Sustained deficit in a tighter market

Silver is quietly slid into structural deficit area. For five even years, global demand has exceeded supply, with the market expected to see another deficit in 2025. By 2023 alone, the deficit only hit 184.3 million ounces. This year’s projected gap? About 215 million ounces-the second largest on record. These are not non -balancing; They point to deeper challenges on the supply side that are not easy to solve.

Mining is not holding up

Production of silver mining peaked in 2016 and has fallen approx. 7% ago. And despite rising prices, output remains muted. Why? Because approx. 75% silver comes as a by -product from mining of other metals such as copper and zinc. This means that silver supply does not respond directly to silver prices – it depends on the economy of other metals. So even though silver prices save, production does not necessarily follow.

Lower qualities, higher cost

Another limitation: The silver ore quality is declining. The average character of the 12 best global projects has fallen 36% in the last decade, while reserve qualities are down almost 40%. Silver extraction is becoming more expensive, and many mining are now facing rising costs and shrinking margins – some even run with negative cash flow despite higher silver prices.

Diminishing inventory and recycling limits

To fill the gap, the market is increasingly tapping above the land inventories. But that well is not bottomless. If demand continues with its current lane, these reserves could be significantly depleted within a year. Recycling offers some relief, but it is not almost enough to close the extended gap between supply and demand.

A slow supply response

Even if miners would increase production today, it wouldn’t happen overnight. New silver projects take years to develop. Industrial analysts agree: It is unlikely that new production will offset the current deficits anytime soon. Meanwhile, the market remains depending on recycling and stocks – both of which are under growing pressure.

This tightening of utility background, combined with increasing demand for industrial and investment, points to a potentially strong setup for silver. For investors seeking underrated assets with long -term upside, it’s a story worth looking at.

The relationship between gold and silver: a key indicator signaling option

One of the most reliable indicators for investors in precious metals is the relationship with gold-silver that measures how many ounces of silver it takes to buy an ounce of gold. This relationship has fluctuated significantly in the last decade ranging from a low level of 70: 1 in 2020 to heights above 85: 1 in 2019 and 2023.

The current relationship remains stubbornly increased compared to the historic average of approx. 60: 1 in the past century. Even more narrative was the relationship through most of the recorded story on average closer to 15: 1, which roughly corresponded to the natural occurrence of these metals in the Earth’s crust.

This sustained imbalance suggests that silver is significantly underestimated in relation to gold by historical standards – considering a unique opportunity for investors to recognize this difference before the market corrects. Barrons recently emphasized that such extended periods of the relationship between the relationship historically have prior to significant silver price movements.

Silver’s superior performance during bull markets

While gold is often seen as the more stable investment, historical data reveals a fascinating pattern: When precious metals come in bull markets, silver typically surpasses gold by a significant margin.

Consider the performance during 2020 when the financial uncertainty drove both metals higher: Gold increased by 25.1%, while silver increased by 47.9%. This pattern is not unique for 2020. Under precious metals Bull Markets, Silver has consistently delivered stronger percentage gains than gold, making it potentially more attractive to investors seeking growth rather than just conservation of capital.

As explained in Mike Maloney’s extensive guide to investing in gold, silver often surpasses gold due to Silver’s smaller market size, which allows relatively less capital flow to create larger percentage price movements.

Wait! Don’t forget your free book

Mike Maloney’s # 1 ALWAYS BESTSelling Investment Guide.

Why silver deserves a place in a diversified strategy

In today’s environment – marked by record debt, currency -down basing and geopolitical uncertainty – makes physical assets a compelling case for admission to any diversified strategy. While central banks accumulate gold, individual investors are increasingly recognizing the silver investment option as a more accessible, higher up -to -year -out economic instability.

Silver’s lower entry point makes it especially appealing to newer investors. And thanks to innovations like Instavaultwhich allows you to average dollar costs in silver with low span and flexible storage or delivery, it has never been easier to get started.

If Gold’s recent performance you have wondered if you have missed the moment, this silver investment option may be your second chance. The relationship with gold-to-silver is stretched, the story is on your side, and the demand story only becomes stronger.

As always, long-term success is about timing the market-it is about owning assets that endure. Silver may be just the metal that helps light the way forward.

Wanna examine how precious metals fit into your portfolio? Whether you want to invest in gold, add silver to your IRA or build a balanced strategy, Goldsilver is here to help you make confident, informed decisions.

Disclaimer: This article is only provided for information purposes and should not be interpreted as SKAT, legal or investment advice. Always consult with qualified tax and financial professionals regarding your specific situation.