Key points:

-

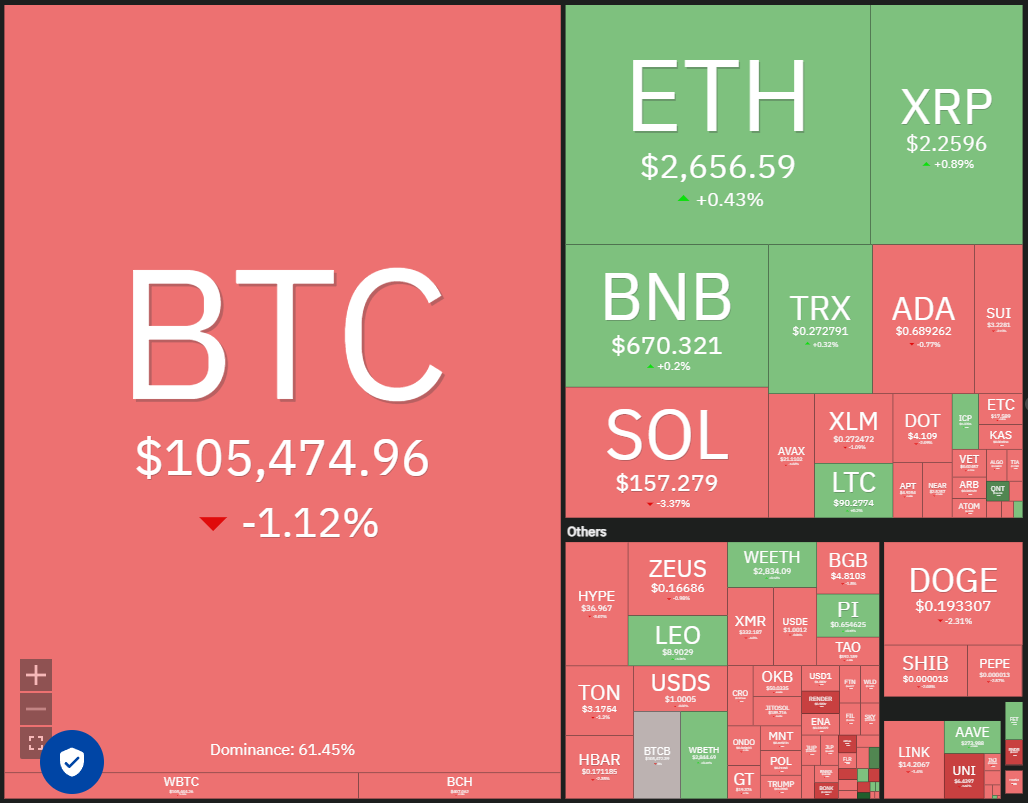

Bitcoin remains in danger of falling to $ 100,000, but the long -term image remains intact.

-

The focus is shifting to choose ALTCOINS, which is about to rise above their respective overhead resistence levels.

Bitcoin (BTC) keeps at the vicinity of the $ 105,000 level, but the bull defect of maintaining the jump on June 3rd suggests a lack of higher levels. Analysts expect Bitcoin to fall to the psychologically crucial level of $ 100,000.

Analyst Willy Woo warned that buying Bitcoin in six numbers may not make sense in the short term, but it may be “one of the best investments you will see in your investment career” within the next 10 years.

Another bullish view came from Sygnum Bank. In his monthly investment prospects, the bank’s analysts said that institutional adoption and the increase in Bitcoin acquisition cars had resulted in a 30% decrease in Bitcoin’s Liquid Supply, which could create “the conditions for demand shock and upward volatility.”

Could Bitcoin Plum to $ 100,000 and pull Altcoins lower? Let’s analyze the charts over the top 10 cryptocurrencies to find out.

Bitcoin prize Forest

Bitcoin is witnessing a tough battle between Bulls and Bears near the 20-day exponential sliding average ($ 105,347).

Buyers get the upper hand if they push and maintain price over $ 106,800. It clears the path of a rally for $ 109,588 to $ 111,980 overhead resistance zone. Sellers are expected to defend the zone with all their power because a break over it could launch the BTC/USDT couple against $ 130,000.

The bears will need to achieve a close below $ 103,000 support to prevent an upside. The couple could then throw themselves into the important support of $ 100,000.

Ether Prize Forest

Ether (ETH) jumped from the 20-day EMA ($ 2,528) on June 2nd, indicating that the mood remains positive and dealers buy on dips.

Bulls will try to strengthen their position by pushing the price over $ 2,738 resistance. If they do, eth/usdt -paret could gather for $ 3,000 and then to $ 3,153.

Time is running out for the bears. If they want to make a comeback, sellers will have to defend $ 2,738 resistance and pull the price during the 20-day EMA. It could sink the couple to $ 2,323.

XRP Price Forest

The XRP (XRP) has risen to the moving average where Bulls are expected to meet sales from the bears.

If the price rejects strongly from the moving average, the XRP/USDT -pair could fall to probably solid support for $ 2. A strong rebound off $ 2 suggests that range action may continue for a while longer.

Alternatively, if buyers drift the price over the moving average, the couple could collect to $ 2.65 overhead resistance. Sellers will defend the $ 2.65 level, but if Bulls wins, the couple can jump to $ 3.

BNB Price Forest

BNB (BNB) rose and closed over the 20-day EMA ($ 661) on June 1st. Sellers tried to withdraw the award during the 20-day EMA on June 3, but Bulls successfully defended the level.

BNB/USDT -PARET could gather for $ 693, probably a significant challenge. If Bulls maintains the pressure and Bulldoze through $ 693, the pair could skyrocket to $ 732 and eventually to $ 761.

In contrast, if the price changes sharply from $ 693 and breaks down during the 20-day EMA, it signalizes a possible range-bound action in the short term. The couple can swing between $ 634 and $ 693 for a few more days.

Solana prize fores

Buyers tried to push Solana (sun) over the 20-day EMA ($ 163) on June 3, but the bears held their land.

A less positive in favor of bulls is that they have not allowed the price to dip below $ 153 support. Bulls will again try to push the price over the 20-day EMA and open the gates for a rally to $ 185.

On the other hand, if the price falls down from the 20-day EMA again, it increases the risk of a break below the $ 153 support. Sol/USDT -pair can fall to $ 140 and then to $ 133.

Dogecoin prize fores

Dogecoin (DOGE) has clung to the 50-day simple sliding average ($ 0.19), indicating a lack of aggressive sales at lower levels.

Bulls will try to push the price over the moving average. If they manage to do so, the Dog/Usdt -paret could collect to $ 0.23 and then to $ 0.26. Buyers need to overcome the barrier of $ 0.26 to signal the start of a new up movement.

In contrast, if the price rejects strongly from the 20-day EMA ($ 0.20), it indicates that bears are active at higher levels. It increases the risk of a fall to $ 0.16 to $ 0.14 support zone.

Carddano prize fores

Cardano (ADA) takes support near $ 0.64, but Bulls have failed to push the price over the moving average.

If the price turns off from the moving average, the bears will try to sink ADA/USDT -paired below $ 0.64 support. The couple could collapse to the decisive support of $ 0.50 if they can pull it off.

Related: Should XRP Price go down again?

Instead of if the price goes over the moving average, it signalizes to buy at lower levels. The couple could reach the downward line, which is a critical level to look after. Buyers will need to push the price over the down -down line to open the gates for a rally to $ 0.86 and later to $ 1.01.

SUI prize fores

Buyers couldn’t push SUI (SUI) back over the 50-day SMA ($ 3.40) in the last few days when dealers sell on rallies.

The moving average are on the verge of a bearish crossover, and the relative strength index (RSI) is on the negative territory, indicating an advantage for sellers. A break and close below $ 3.05 could sink the SUI/USDT couple to $ 2.86.

This negative view will be invalid in the short term if the bulls push the price over the moving average. If they manage to do so, the couple could march against $ 3.90 to $ 4.25 overhead zone.

Hyperliquid Price Forest

Buyers pushed hyperliquid (hype) over $ 35.73 overhead resistance on June 2nd, indicating solid purchases on DIPs.

Sellers tried to withdraw the price under $ 35.73 on June 3rd but Bulls held their land. Buyers will try to push the price over $ 40 and challenge the rigid overhead resistance to $ 42.50. If the level of $ 42.50 is scaled, the hype/USDT pair may increase to $ 50.

The 20-day EMA ($ 32.33) is the crucial support to look after the disadvantage. A break and close during the 20-day EMA will be the first sign of profit booking of the short-term buyers. The couple could slip to $ 30.59 and then to $ 28.50.

Chainlink Price Prediction

Chainlink (Link) appeared from $ 13.20 support on May 31, but buyers continue to sell near the resistance line for the falling channel pattern.

The 20-day EMA ($ 14.90) has begun to reject and RSI is in the negative zone, indicating that bears have a small edge. Buyers will need to pierce the resistance line to seize control. LINK/USDT CAR CONTRIBUTION CANTERSED TO $ 18, where the bears are expected to mount a strong defense.

Sellers probably have other plans. They will try to pull the price below $ 13.20 support. If they do, the couple can extend their stay inside the channel for more time.

This article does not contain investment advice or recommendations. Each investment and trade movement involves risk, and readers should make their own research when making a decision.