Introduction: Why does everyone buy gold from Costco?

In recent years, Costco has emerged as an unexpected player in the market for precious metals, where their gold bars became one of their fastest selling objects. As economic uncertainty persists and inflation concerns Mount, Americans are increasingly regarding gold as a safe port for their wealth. This trend has propelled Costco – traditionally known for bulk -daily products and household essential things – in the limelight as a gold dealer. But represent the purchase of gold from this warehouse giant good value? This analysis examines the advantages and disadvantages of helping potential investors to make informed decisions.

Why Costco has become a gold-selling power center

Costcos foray to precious metals has received considerable attention for several compelling reasons:

Competitive pricing structure

Costco typically offers gold bars at prices relatively close to the site, with markings often lower than for traditional jewelers or banking institutions. However, they are still higher than for specialized dealers like Bullionstar.

Established trust and reputation

With decades of establishing consumer confidence through fair pricing and quality herchandise, Costco’s reputation gives buyers peace of mind; However, this General Retail Forest does not automatically specialize in precious metals.

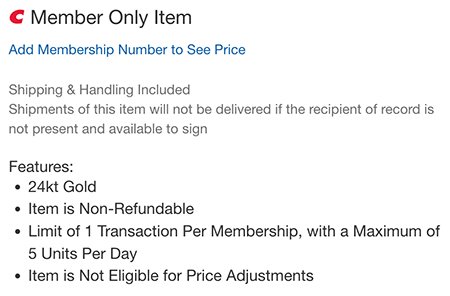

| Exclusive membership advantage Gold purchases are limited to Costco members only, creating both a controlled distribution channel and a further perceived value for members of membership, albeit with an annual membership fee that adds the total acquisition costs. |

|

Streamlined online shopping

The simplicity of Costco’s online platform allows members to buy gold bars with the same ease as ordering everyday goods. The company changes discreet gold bars directly to their homes.

Critical Analysis: Is Costco Gold really a good investment?

While convenience and trust make Costco an attractive opportunity, investors should weigh more important factors:

Benefits of buying gold through Costco

Transparent pricing

Unlike some dealers who hide actual costs of hidden fees, Costco clearly shows pricing that is regularly updated to reflect the market conditions.

Insured authenticity and quality

Costco sells exclusively 24 carat gold rods from internationally respected refineries such as Pamp Suisse and Royal Canadian Mint. Each beam comes properly certified with assaycard and manipulation-vefer packaging.

Purchase of convenience

The ability to buy gold in investment quality through a well -known retail platform removes many of the intimidation factors that new gold investors often experience.

Significant restrictions in the Costco Gold program

Online-Kun availability and frequent stock problems

Despite being a physical dealer, Costco does not offer gold purchases in the store. All transactions must be completed online without the possibility of immediate possession. More problematic, their gold inventory often sells out within minutes of reconstruction, creating frustrating experiences for potential buyers who can wait weeks for another option.

Full absence of repurchase program

One of Costco’s most serious disadvantages is the overall lack of a repurchase option. When investors decide to run their gold possessions, they must find alternative buyers through gold dealers or exchanges, which potentially incurs additional transaction costs and faces price differences that erode investment returns.

Selection of severely limited product selection

Costco’s gold offering is remarkably limited and focuses almost exclusively on 1-ounce gold bars. This absence of fractional weights, coins or other precious metals creates significant portfolio restrictions and lacks the diversification options that serious investors require.

Premium Disadvantage

While Costco’s prizes appear consistently exceeded by specialized gold dealers such as Bullionstar, especially for larger purchases where volume discounts become significant. The membership fee is increasing the effective premium paid.

No Consulting Services or Investment Guide

GOLD IRAS: A critical option costco cannot deliver

For pension -focused investors, a significant limitation of Costco’s gold program is the complete inability to integrate with precious metals IRAs. Gold IRAs offer significant tax benefits for retirement planning that physical gold purchases from Costco cannot match:

Gold IRA benefits

- Taxed or tax -free growth Potential (depending on traditional or Roth structure)

- Specialized storage solutions meets the IRS requirements

- Protection against bankruptcy and certain creditor claims

- Professional portfolio management With strategic allocation of precious metals

- Simplified required minimum distribution Handling when you reach retirement age

Comparative analysis: Costco vs. Bullionstar and other specialized gold dealers

| Function | Costco | Bullionstar |

| Product selection | Severely restricted (primarily 1 oz bars) | Extensive (coins, bars, different weights, more metals) |

| Price structure | Higher prizes with additional membership costs | Lower prizes, transparent prices, volume discounts |

| Liquidity options | No repurchase program | Established repurchase options with competitive prices |

| Approval | Basic certification | EXPERIENCE APPLICATION including advanced test capabilities |

| Inventory reliability | Often sold out for extended periods | Consistent storage accessibility |

| Advisory services | No | Expert Market Guide |

| Storage solutions | No options are provided | Safe storage of vault with insurance and audit verification |

| Gold IRA Support | No | IRA, Superan Financial or Pension Accounts. |

| Educational resources | Minimal product descriptions | Extensive market analysis, investment guides and historical context |

| International Shipment | Limited | Global range with safe delivery options |

Why Bullionstar surpasses Costco for serious gold investors

Bullionstar represents a superior alternative to Costco for acquiring precious metals due to several crucial benefits:

Real market expertise

Unlike Costco’s general retail method, Bullionstar is only specialized in precious metals using analysts and experts who understand market dynamics, provide valuable insights and control investment decisions based on current financial conditions.

| Extensive product ecosystem Bullionstar offers a complete selection of precious metals of investment quality, from fractional gold and silver coins to large bars, allowing investors to build strategically diversified portfolios tailored to specific goals. |

|

| Superior repurchase program Perhaps the most significant benefit over Costco is Bullionstars established repurchase program that offers transparent pricing and immediate liquidity – a critical consideration for any serious investor. |

|

| Safe storage solutions Bullionstar’s secure Vault storage options provide investors with insurance-backed, revised warehouse facilities that eliminate security concerns for self-insurance while maintaining direct ownership and access. |

|

Educational foundation

Bullionstar’s comprehensive market analysis, research publications and educational resources create informed investors who not only understand what to buy, but why and when – a sharp contrast to Costco’s minimal product information.

To make the right decision on gold purchases

For relaxed or first time gold buyers

Even for Nykomere, Costco’s limitations present significant disadvantages. While the well -known brand may provide initial comfort, they create limited options, frequent warehouse shortages and complete absence of repurchase regulations potential complications that specialized dealers such as Bullionstar avoid through extensive service offers.

Too severe precious metals investors

Investors with meaningful allocation plans or specific strategic goals would be a significant benefit from establishing relationships with reputable gold dealers such as Bullionstar and accessing:

- Significantly more competitive prices on all the amounts of purchase

- Comprehensive product diversity for portfolio optimization

- Established repurchase programs that ensure immediate liquidity

- Expert guidance on market conditions and acquisition dimming

- Secure storage options with insurance and verification

- Tax -Distributed Investment Structures Including Gold IRAs

Essential considerations before any gold purchase

Whether it chooses a specialized dealer like Bullionstar or a mass dealer like Costco, careful investors should observe these basic principles:

Make thorough price comparisons

Always check current spot prices and compare prizes across multiple suppliers before completing any purchase. Even small percentage differences can represent significant amounts of valuable raw materials.

Establish secure storage solutions

Physical gold requires appropriate security measures. Determine whether you are using residential storage (requires safe safes and potential additional insurance) or professional vaulting services before acquisition.

Consider future liquidity requirements

The ability to effectively convert gold back to currency is a crucial aspect of any noble metal strategy. Sellers offering guaranteed repurchase programs provide significant benefits as market conditions change.

Understand tax consequences

For retirement planning, explore Gold IRA options with specialized dealers rather than simple physical acquisition through retailers like Costco.

Conclusion: Strategic approach to Gold Investment

While Costco Gold represents genuine noble metal in investment quality, its serious restrictions in product selection, frequent accessibility problems, complete lack of repurchase regulations and inability to support tax -distributed structures such as Gold IRAs make it a fundamental compromised opportunity for serious investors.

Specialized dealers such as Bullionstar provide a comprehensive ecosystem to the ownership of precious metals – from acquisition through storage to any liquidation – with pricing benefits, market expertise and investment guidance that mass dealers simply cannot match.

The basic principle remains constant: Informed investors compare opportunities thoroughly, understand the complete ownership life cycle and make decisions based on the total cost of acquisition and possibly liquidation rather than the first purchase price alone. Following these standards, specialized gold dealers are consistently transcending general retailers in the supply of superior value and service to precious metal investors.