Key takeaways:

-

A Bearish divergence in 2021 style on the weekly map points to a potential 50%+ correction against $ 64,000.

-

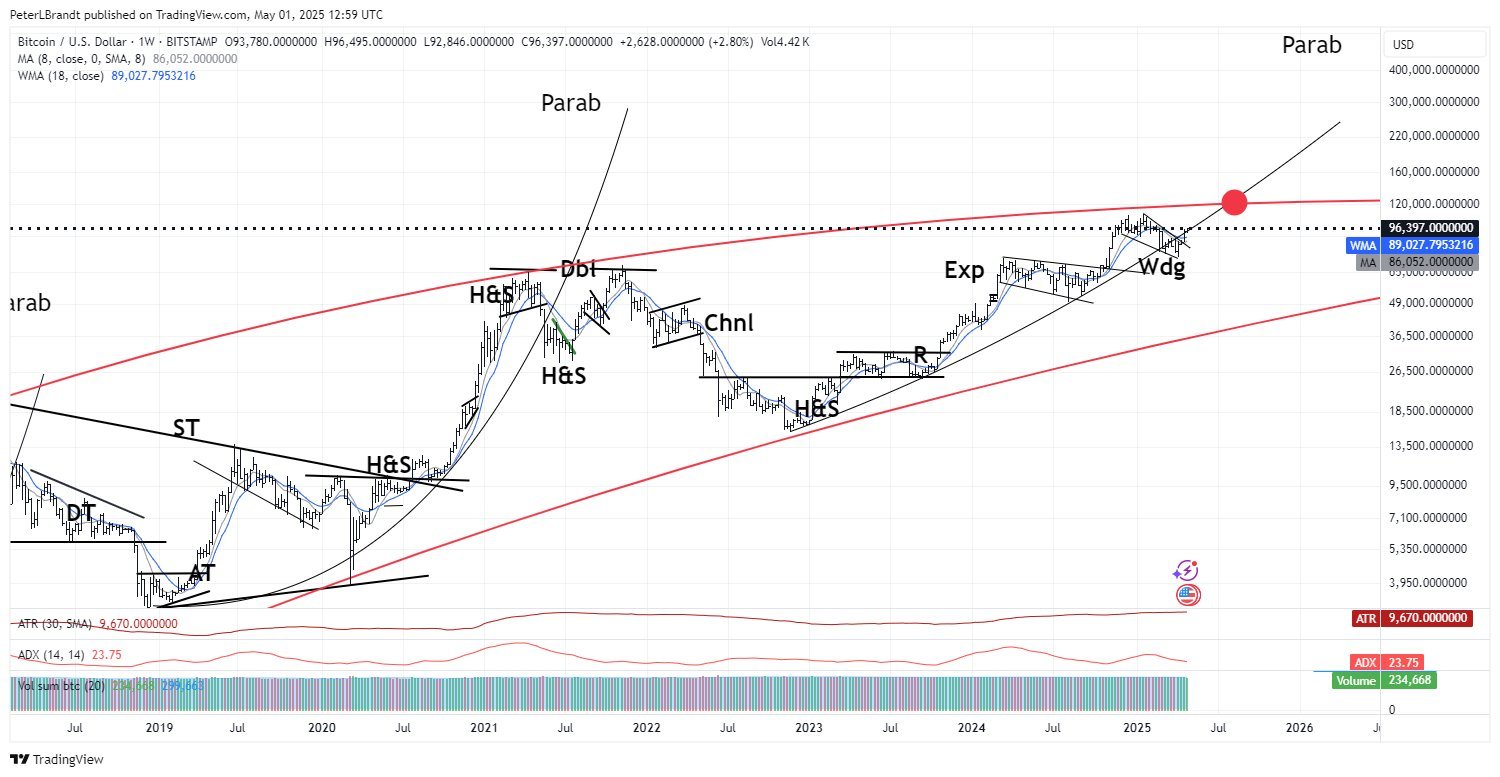

Peter Brandt warns Bitcoin must soon regain his parabolic trendline or risk ending his bull cycle before reaching the $ 150,000 target.

Bitcoin’s (BTC) wave for record $ 112,000 triggered the re-elected hopes of a $ 150,000 target at the end of the year, but its rapid correction under $ 105,000 tests the bullish narrative.

Does Bitcoin paint a Bearish Reversing Setup?

Bitcoin paints what seems to be a reverse cup-and-handle pattern, with its neckline near $ 100,800 that acts as current support. From June 7, the award has entered the handle -formation stage and seen a breakdown during the neckline.

Based on the inverse cup-and-commerce-pattern setup, a collapse of below $ 100,800 will increase Bitcoin’s likelihood of falling against $ 91,000.

The target of $ 91,000 downward matches the BTC’s 200-day exponential sliding average (200-day EMA; The Blue Wave).

Bitcoin’s Relative Strength Index (RSI) has fallen in tandem with its price and signalizes strong trader beliefs behind the ongoing sales.

From June 7, RSI was 52, which reflects a weakened upward momentum; A break below 50 could intensify downward pressure.

To regain control, Bulls must regain Bitcoin’s 20-day EMA (the purple wave) resistance of about $ 105,000 levels. A decrease against $ 91,000 could effectively lower BTC’s potential to hit $ 150,000 by the end of 2025.

2021 Fractal suggests that BTC does not hit $ 150,000 in 2025

On a wider schedule, Bitcoin’s weekly chart flashes a well -known warning.

A bearish divergence has been formed between price and RSI, mirroring the 2021 cycling top when RSI trend lower despite higher price heights. This divergence preceded a correction of 61% against its 200-week EMA (The Blue Wave) and below.

A similar structure is now visible with a divergence that is formed just under $ 112,000 high and a projected withdrawal target near the 200-week EMA of about $ 64,000, marking a potential 52% fall.

This historic setup raises doubts that Bitcoin when it was widely discussed $ 150,000 targets by the end of 2025, especially if the divergence confirms a wider market stop similar to previous bikes.

Veteran trader Peter Brandt adds additional weight to this vision.

In his May 2025 analysis, Brandt identified an increasing wedge pattern and warned that Bitcoin should regain his parabolic trendline to remain on track for a $ 125,000 – $ 150,000 cycle top by August or September 2025.

He notes that failure to do this could mark the end of the current Bullish cycle – potentially trigger a typical 50-60% step -down after previous peaks.

Gold’s trajectory, Bitcoin “Bull Flag” tip for a $ 150,000

Despite growing technical warnings, some analysts remain secure on Bitcoin’s way to $ 150,000.

Dealers see similarities between Bitcoin’s current market structure and Gold’s explosive breakout in the 2000s. They claim that BTC could mimic Gold’s historic track and reinforce the scenario of $ 150,000.

Analyst Tony Severino quotes a potential bull flag structure to predict a BTC price boom against $ 150,000.

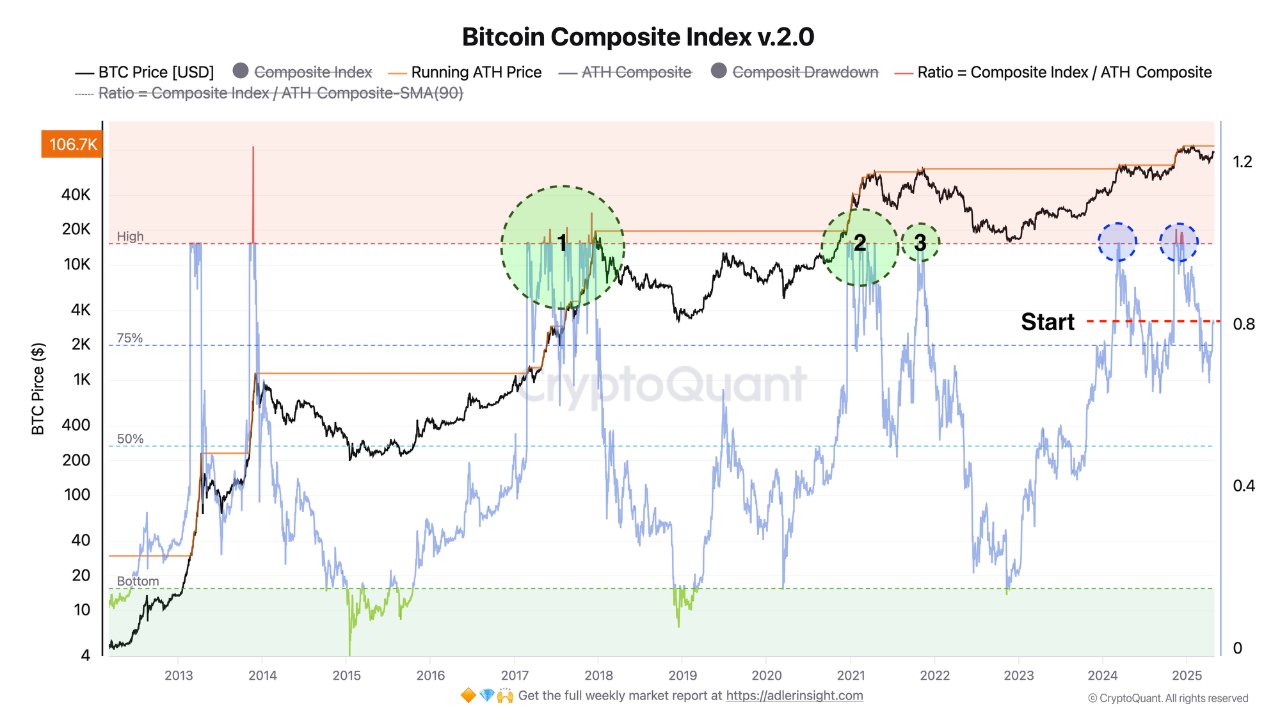

From an onchain perspective, Bitcoin researcher Axel Adler Jr. BTC is approaching a critical “start” rally zone based on historical cycle patterns.

If the NUPL/MVRV ratio breaks down and holds over 1.0, it would indicate the start of a new bullish impulse, notes the analyst and says it could push Bitcoin’s award against the range of $ 150,000- $ 175,000, corresponding to Rallies seen in 2017 and 2021.

This article does not contain investment advice or recommendations. Each investment and trade movement involves risk, and readers should make their own research when making a decision.