Brandon Sauerwein, editor

Last week, Gold made history. This week it catches the weather.

After an explosive wave to a height of all the time of $ 3,500 per Ounce — a fastest bull runs in Gold’s history-is prices withdrawn to about $ 3,300. Some may be wondering if the rally has topped. But for experienced investors, it looks less like a top … and more like a textbook that buys the opportunity.

Because the forces behind Gold’s Rise have not faded – they are accelerating. Consider this:

- Gold is still more than 28% years to date

- Central banks continue to add reserves – especially in the east

- Global de-dollarization accelerates in the midst of geopolitical adaptation

Mike Maloney believes we are in the early stages of a massive monetary reset – and that gold is nowhere near its final destination …

What if the future of money is not digital – but gold?

https://www.youtube.com/watch?v=jlynhfhiyyw

In its newest must-watch video, Mike Maloney presents his boldest argument yet For a new gold-supported globally monetary system and a potential gold price of $ 10,000.

With Treasury Secretary Scott BessentGlobal central banks and large hedge funds like Bridgewater, which now openly demand monetary reform, are the characters everywhere:

- Mike believes that a new Bretton Woods-style deal possibly brewing

- China stores goldWhile the US quietly replenish its own reserves

- ONE $ 10,000 gold price May not just be possible – it may be important after the monetary reset on the horizon

“We are not at the end of this system. We are on the edge of the next. And gold will be at the center of it.” – Mike Maloney

If you are watching a video this week, do this to this one.

Why this withdrawal could be the best entry point all year

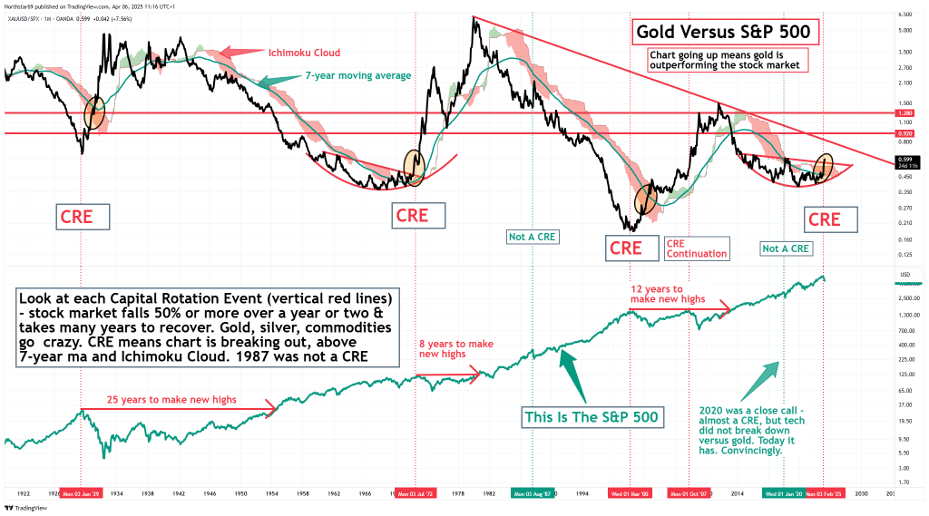

In a powerful new panel, Alan HibbardAt Kevin Wadsworthand Patrick Karim revealed why we might be in the early stages of a rare and historical Capital rotation event – A change of wealth from overrated paper assets to specific stores with value such as gold and silver.

These rotations are rare. But when they happen, they transform the financial markets. Consider:

- 1929: After the crash it took 25 years for the S&P 500 to recover

- 1972: Post-nifty fifty bubble the stocks needed 8 years to recover their heights

- 2000: After tech -bust it took 12 years for S&P to jump back

Source: Northstar Bad Diagrams

In both cases, Capital fled stocks and fled into gold and silver. Those who moved early caught big winnings.

Secure bulk prices on each gold and silver purchase

What else is the news?

📉 Three-year-old growth traits end as the US economy shrinks at the beginning of 2025

The US economy shrunk by 0.3% in the first quarter of 2025, marking the first economic contraction in three years. This fall was slightly worse than economists’ expectations for a fall of 0.2% and represent a significant slowdown from the 2.4% growth recorded by the end of 2024. Bureau of Economic Analysis says that the contraction is partly an increase in imports – which withdraws from GDP – when companies rushed to secure goods in front of new tariffs.

Markets react strongly to the news. At the time of writing, DOW is down as much as 700 points as investors digest the financial slowdown.

🚢 US Supply Chains Brace for Impact When China -Tariffs Start Biting

President Trump’s 145% duty on Chinese goods has already caused shipping shipments to throw 60% since the beginning of April. The ripple effects are imminent: large retailers like Walmart and Target warn of empty shelves and rising prices in mid-May as inventory thin. Even if the trade negotiations are soon resumed, restarting imports could overwhelm the logistics network – repeat the shipping tinks and cost tips seen under the pandemic.

💵 Trump -Takster slams the dollar – worst falls since 2002

The US dollar is on the field for its biggest decline in two months over 20 years, falling 7.7% in March and April. The fall was triggered by Germany’s stimulus plans (increased the euro) and Trump’s Customs War (leading investors to secure port currencies). While reports of possible duty exempt gave the dollar a modest rejection on Tuesday, foreign investors remain on duty against US assets in the midst of the chaotic trade negotiations.

💳 Credit crisis: Fed warns of the highest consumer distress of 12 years

Financial load builds. The Federal Reserve Bank of Philadelphia reports 11.1% of Americans now only make minimum payments on their credit card – the highest rate since 2012. Crime also increases, driven by years of inflation and increasing dependence on debt too important. With average credit cards now over 21%, households feel pressured.

📉 Gold pulls back after $ 3,500 peak

After a record-breaking run-28 new heights and a 28% YTD win-win-is gold cooled to about $ 3,300. For long-term investors, this can be a healthy reset and potentially a strong entry point.

📊 Goldman Sachs confirms $ 4,500 gold tail risk

Goldman Sachs believes this withdrawal could be temporary. They have just raised their targets from 2025 to $ 3,700 – and say gold could spike to $ 4,500 if the markets face a fat pivot or wider systemic stress. In their view, the upside remains very alive.

💬 What Goldsilver -Investors say

Ny ⭐ ⭐ NO CUSTOMER SERVICE is very useful!

“Travis was amazing! I had a hard time with a thread transfer of the savings of my life, and I was very worried that I might not be able to receive it all. My husband just died and I have been worried about these funds with mourners for 8 months. As soon as I got joined with Travis, my concerns were immediately addressed and he was easily the funds.

Experience the Goldsilver difference:

- Receive expert guidance from dedicated precious metals specialists

- Access to comprehensive educational resources to master your investment strategy

- Trust our industry -leading customer service team that puts you first

Ready to get started?