Key points:

-

Bitcoin RSI data forms a bearish divergence that gets dealers in position to lower levels next.

-

The monthly Candle Candle Close Seals 11% winnings, but the weekly closure is the event on the radar for market participants.

-

Areas of interest rates include $ 97,000 as well as the psychologically significant $ 100,000 brand.

Bitcoin (BTC) tried to preserve 2024 All-Time Highs on June 1st after the monthly Candle Close delivered 11% winnings.

Bitcoin RSI Divergence Primes Traders for New Lows

Data from COINTELEGRAPH MARKETS PRO and TradingView showed BTC/USD attempt to recover $ 105,000 for the weekly closure.

Persistent disadvantage during the week brought Bitcoin back into contact with significant level of support from earlier in the bull market.

Among these was the local top from December 17, 2024, about $ 104,450.

Comment, the popular trader Matthew Hyland described the weekly close level as “pivotal.”

#Btc Weekly Close Now Pivotal pic.twitter.com/qfvhnvruba

– Matthew Hyland (@matthewhyland_) May 30, 2025

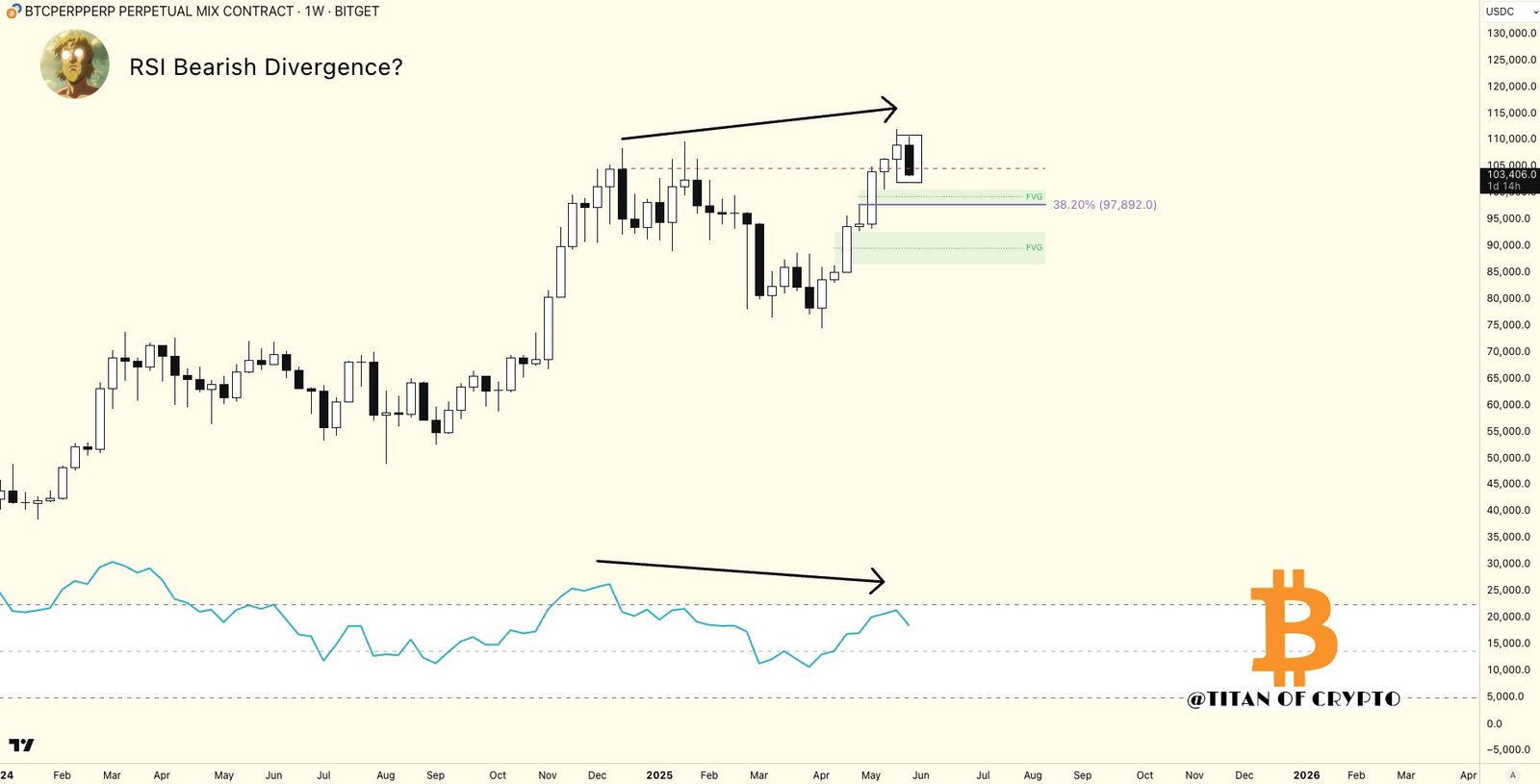

Hyland uploaded a diagram showing a bearish divergence between price and the relative strength index (RSI) on weekly time frames.

RSI is a classic trend strength indicator that measures momentum at given pricing points.

Continued, colleague Titan from Crypto warned that the divergence could have wider consequences for bulls.

“A potential RSI -Bearish divergence is formed on the weekly chart. Still the unconfirmed, but worth seeing,” he told X -supporters on May 31.

An accompanying diagram referring to so-called hero values (FVGS) measured by Fibonacci Retracement levels, and these show imbalances between buyers and sellers as price rose to its current area.

Two fvg zones of interest were at $ 97,000 and $ 90,000.

“After a +50% race, a cooling down would not be a bad thing. Healthy market structure matters,” Titan acknowledged Crypto.

BTC Award utilization “Intact”

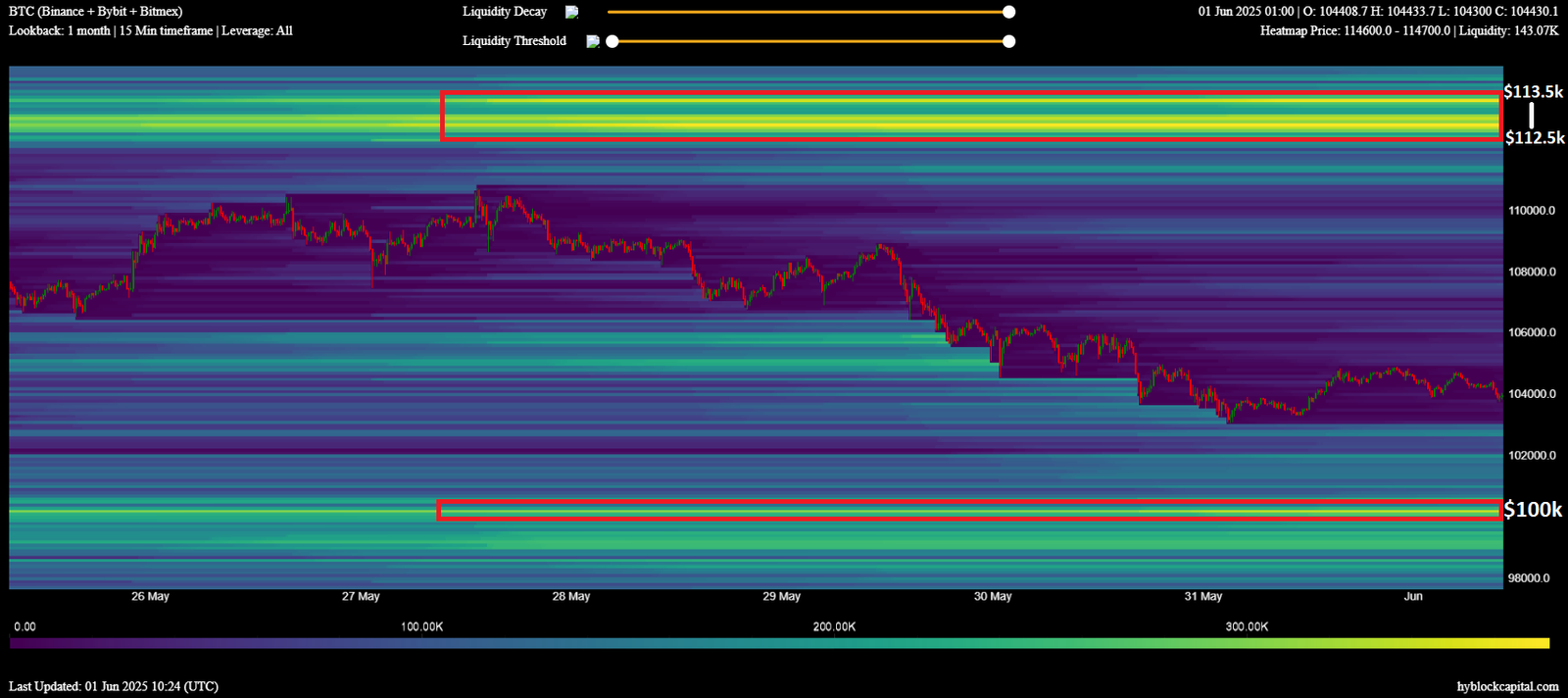

Based on order book Liquidity data suggested Trader CrypNuevo that $ 100,000 could function as a pricing if the market falls further.

Related: How low can the Bitcoin price go?

“It is a strong psychological level and liquidity tends to stack in these levels. Potential gene test of this level first,” reads part of an X thread of the day.

CrypNuevo maintained the belief in the overall bullish market structure despite BTC/USD, which fell 8% over the past week.

“So I think we’re likely to fall to $ 100,000 and play around there for a few days – even a slight temporary fall under it to shake the market would make sense.” He finished.

“But in the big picture we have the bull market support for $ 84K to catch up with the price; Uptrend is intact; the liquidity is over.”

This article does not contain investment advice or recommendations. Each investment and trade movement involves risk, and readers should make their own research when making a decision.