Key Takeaways:

-

Bitcoin Futures -The demand continues to rise despite the recent pricing, which indicates sustained trader engagement.

-

Put options maintained a prize over calls, reflecting sustained bearish atmosphere among investors.

Bitcoin (BTC) traded at $ 109,400 Monday, its lowest level of more than six weeks. The correction followed a $ 11 billion sale of a 5-year-old sleeping whale who had been sleeping for 5 years, with revenue rotating to Ether (Eth) spot and futures on decentralized exchange hyperliquid.

Despite the fall in prices, demand for Bitcoin futures increased to a highest time, prompting dealers to ask if $ 120,000 is the next logical step.

Bitcoin Futures Open Interest rose up to a highlight of all the time on the BTC 762,700 Monday, an increase of 13% from two weeks earlier. The stronger demand for geared positions shows that dealers do not abandon the market despite a 10% price drop since Bitcoin’s constantly high on August 14.

While this is a positive indicator, the $ 85 billion in Futures’s open interest does not necessarily reflect optimism as long (buyers) and shorts (sellers) always match. If bulls are leaning too strongly on leverage, a dip below $ 110,000 can trigger cascading liquidation.

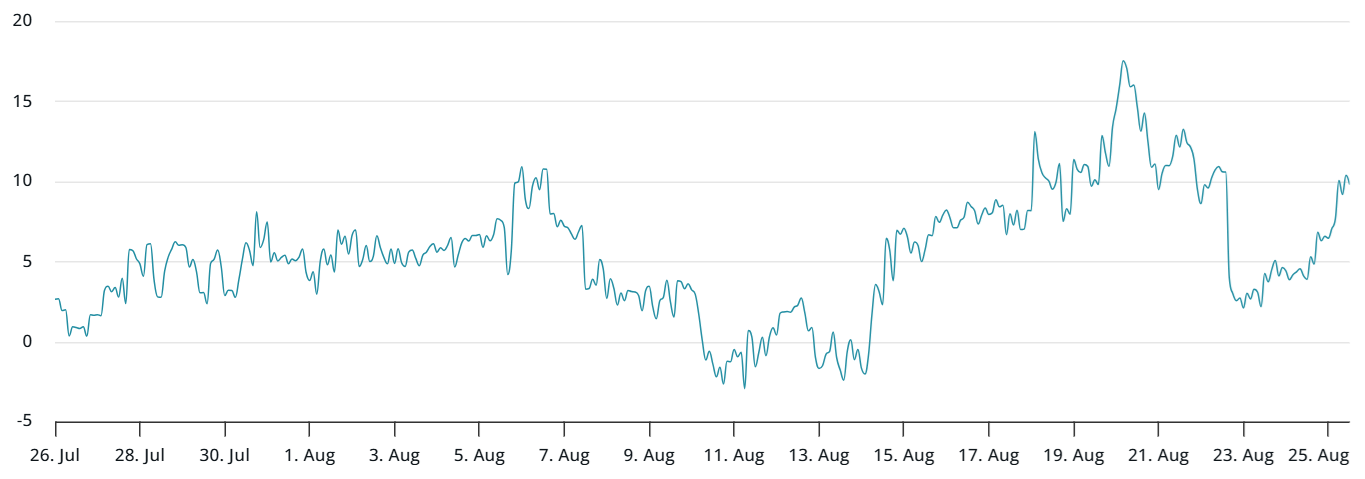

Bitcoin Futures Premium is currently on a neutral 8%, up from 6% the previous week. In particular, the metric has not remained over the 10% neutral threshold for more than six months, which means that even the $ 124,176 could not input wide Bullishness all the time.

Leverage Shakeout highlights liquidity but sparks suspicion

The recent decline blindly survived traders, which led to $ 284 million in the liquidation of long positions, according to coinglass data. The event showed that Bitcoin maintains deep liquidity, even on the weekends, but the execution speed raised suspicion, given that the seller had had the position for years.

Bitcoin Perpetual Futures financing rate fell back to 11% after a short-term Uptick. In neutral markets, the rate usually varies between 8% and 12%. Some of the muted moods can be explained by $ 1.2 billion in net outflow from US-Listed Spot Bitcoin ETFs between August 15 and August 22.

To assess whether this level of caution is worrying, dealers should investigate the BTC option market.

Put (Sell) options are currently dealing with a 10% prize over call (buy) instruments, a clear sign of bearish mood. Although excessive fear is clear, it is not unusual after a $ 6,050 Bitcoin price drop in just two days. Market psychology has probably been affected by whales changing exposure from Bitcoin to ether, although such currents tend to stabilize over time.

Related: Strategy buys $ 357 million

Although the recent weakness is weighed on the mood, the prospect of a Bitcoin -rally against $ 120,000 has not disappeared. Still, any sustained upside is probably related to renewed spot -TF flow, especially as global growth remains uncertain. Currently, the expiry of $ 13.8 billion can expire on Friday to serve as a catalyst, who decides whether investors are coming back on the market.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and statements expressed here are the author’s alone and does not necessarily reflect or represent the views and opinions from Cointelegraph.