Tucked away in the rolling hills of Kentucky stands an impressive structure that has caught the imagination for generations: the United States Bullion Depositum in Fort Knox. This fortress of concrete and steel is said to house most of America’s gold reserves.

After decades of speculation and advocacy, we stand at a historic turning point with unprecedented opportunities for transparency in this legendary facility.

The long way to transparency

The Fort Knox Deposition, which was completed in 1936, was designed to secure America’s monetary gold reserves during a turbulent period in economic history. The construction of the facility followed executive order 6102, which required American citizens to surrender their gold holdings to the Federal Reserve in exchange for paper currency.

While the facility’s safety measures are legendary-with walls of concrete-enclosed granite, a bomb-proof roof and a 22-ton vault-door-to-the-true fortress in the secrecy wall around its contents. The last comprehensive revision of Fort Knox Gold took place in 1953 during the Eisenhower administration. Since then, only partial inspections have been performed and no one has met the strict standards expected in modern financial audit.

From fringe movement to mainstream -policy

The journey towards transparency has not been straightforward. In the early 2000s, congressman Ron Paul emerged as a prominent spokesman for accountability, which made the audit of Fort Knox a key issue in discussions about monetary policy. Although these original efforts faced considerable resistance, they set the stage for today’s groundbreaking development.

When advocates began to demand greater transparency in 2008, these requests were often brushed off as fringe problems. Today we are witnessing not only the potential of a Fort Knox audit, but also wider initiatives, including:

- Extensive Federal Reserve Transparency Measures

- Discussions about Gold’s role in monetary policy

- Deflassification of key financial documents

- Reform initiatives to major government institutions

Trump -Administration’s obligation to transparency

The current administration’s obligation to revise Fort Knox denoting a significant step towards improved government responsibility. While the audit details remain unclear, I am cautious hope that this step will lead to greater transparency.

Critical questions that require answers

Despite this progress, there are still more critical concerns about Fort Knox’s gold reserves:

Physical verification: No independent auditors have been allowed to complete a complete physical inventory and analysis of the gold and raise questions about its actual presence and purity.

Bottoms: There is little transparency about whether gold is rented, swapped or otherwise occupied through financial events with foreign units or banks.

Quality assurance: Fort Knox Gold was last quality tested decades ago and raised concerns about its purity and consistency.

Why this means more than ever

The importance of Fort Knox’s transparency extends far beyond pure curiosity. The gold held in its vaults represents a significant part of America’s monetary reserves, which then affects global economic stability.

For American citizens

The gold at Fort Knox ultimately belongs to the American people. As taxpayers and stakeholders in the country’s financial system, citizens have the right to understand the actual status of their national taxes. This transparency is even more important as Americans increasingly recognize the importance of including precious metals in their investment portfolios.

Why individual gold ownership matters

The rationale for keeping gold extends beyond mere portfolio sightsification:

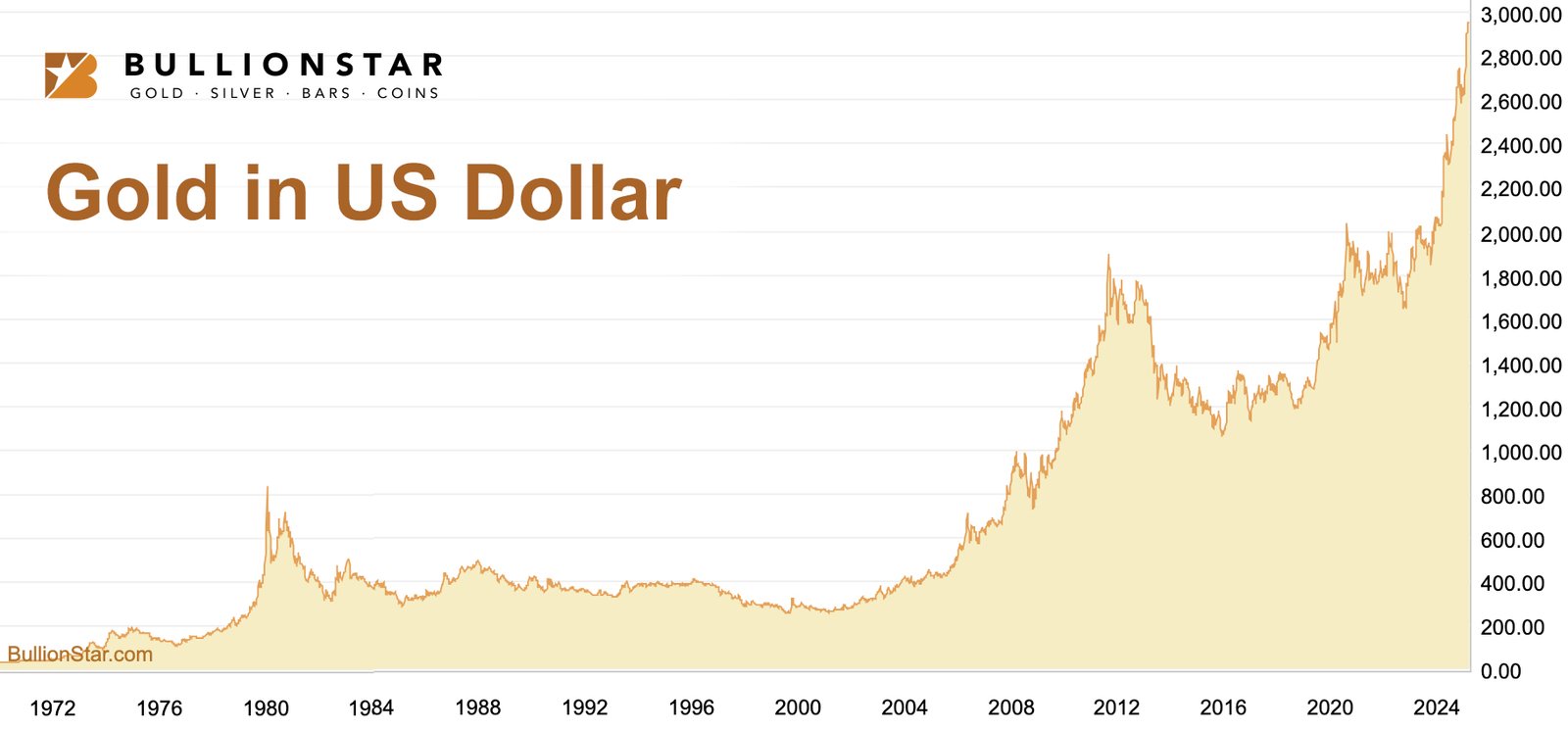

Wealth Conservation: Throughout history, gold has maintained its purchasing power over the centuries and protected from currency indignation and financial uncertainty. While paper currencies have repeatedly lost value due to inflation and monetary policy changes, gold has consistently retained wealth across generations.

Economic independence: Owning physical gold reduces individuals their dependence on the traditional banking system and government -controlled monetary policy. This independence becomes particularly significant during periods of financial stress or systemic banking problems.

Portfolio protection: Gold typically moves reverse to traditional financial assets such as equities and bonds, providing crucial protection during the downturn of the market. E.g. During the 2008 financial crisis, gold protected significant investors, while many other assets fell sharply.

Inflation defense: As governments all over the world participate in unprecedented monetary expansion, gold acts as a proven hedge against inflation. Unlike Fiat currencies that can be created as desired, the delivery of gold is increased with a predictable and limited rate.

It is important to acknowledge that gold is not only an ‘investment’ that must be awarded together with shares and bonds, but rather the basis of audio money itself.

Throughout history, gold has served as the ultimate unit of measurement for which all other assets are appreciated. When we talk about ‘buy’ gold with Fiat currency, we actually convert unstable government-issued currency back to real money. This perspective changes the entire paradigm – rather than asking how much gold to add to a portfolio, it becomes wiser questions, how much Fiat currency and other assets to temporarily hold with their core gold savings.

Gold represents the basis of financial security rather than a purely diversification tool where physical possession serves as true monetary sovereignty in an increasingly insecure world. This understanding transforms how individuals approach wealth preservation that moves beyond conventional portfolio theory to recognize Gold’s rightful place as money in themselves.

Implementation of personal gold ownership

Effective gold ownership requires careful consideration of multiple factors:

Storage options

Product selection

Purchase strategy

Documentation and insurance

The connection to Fort Knox

The transparency of Fort Knox’s gold stocks directly affects citizens’ confidence in the wider monetary system. When citizens understand the actual condition of national gold reserves, they can make more informed decisions about their financial security. This includes:

- Evaluation of the actual support of the US dollar

- Understanding the country’s capacity to respond to economic crises

- Evaluation of the need for personal gold stocks as a supplement to national reserves

- To make informed decisions about portfolio allocation to precious metals

To global markets

Fort Knox’s Gold Holdings are important for international financial confidence. The uncertainty about these reserves can affect:

- Global Gold Prices and Market Stability

- International confidence in the US dollar

- The credibility of US financial institutions

- The wider international monetary system

For future generations

Transparency in government holdings is important to maintain confidence in financial institutions and ensure responsible management of national assets.

Modern solutions for modern challenges

Technology provides many solutions to perform extensive revisions while ensuring security:

- Non-invasive test methods for verification of golden unit

- Blockchain-based inventory systems for transparent trackin

- Independent audit protocols used by larger private vaults

- Real-time monitoring systems for continuous verification

Bullionstar’s leadership within transparency

At Bullionstar, we have long shown that complete transparency in precious metals storage is not only achievable but crucial. Our practice includes:

- Full allocation and separation of stored metals

- Regular third -party audits

- Detailed documentation of all holdings

- Customer access to physical verification

- Public reporting of audit results

These standards have helped to establish benchmarks for what is possible in modern bullion storage and verified that security and transparency can exist effectively.

At Bullionstar we have asked tough questions for over a decade. We continue to advocate for transparency in revision of gold reserves and are proud to be leaders in this discussion.

Addressing skepticism while embracing progress

While some long -standing advocates express skepticism about potential audit results, especially regarding gold hefting, it is important to recognize the historical nature of this moment. The mere fact that we are discussing an official audit, signifying unprecedented progress within the government’s transparency.

The path forward

The obligation to revise Fort Knox represents more than just a single political decision; It is a victory for decades of advocacy and a testimony to the power of sustained calls for accountability. To go ahead requires:

-

- Establishing an independent audit commission

- Implementation of modern verification technologies

- Creating transparent reporting mechanisms

- Developing ongoing monitoring protocols

- Building Permanent Supervisory Mechanisms

Conclusion

At this central moment we can acknowledge how far the movement of economic transparency has emerged. What was once considered a fringe problem has been transformed into mainstream policy that illustrates the impact of relentless advocacy and changing public expectations.

At Bullionstar, we are proud of our role in the journey towards greater transparency in precious metal storage. Our long-standing commitment to full accountability and customer access highlights what can be achieved in modern Bullion storage. Each ounce of gold in our custody is fully awarded, separate and uniquely identifiable. Customers can physically inspect their precious metals at any time, and we maintain detailed items of all columns and coins, including specifications, serial numbers and photographs.

The upcoming Fort Knox audit and wider transparency initiatives do not denote a endpoint, but a new beginning. They provide an opportunity to establish new state accountability and economic transparency standards that will benefit future generations. By maintaining appropriate skepticism and attention to detail, we can celebrate this historic progress as we continue to advocate for even greater openness in our financial systems.

This thorough revision of Fort Knox’s gold reserves is desirable and decisive for market stability, public trust and financial responsibility. As the private sector leaders in Bullion storage have shown, the technology and procedures are already in place.

It is a matter of political will and public demand for accountability. The front path presents challenges, but the direction is unequivocal – violation greater openness, responsibility and confidence in our financial institutions.

Take action: secure your wealth in uncertain times

While we wait for greater transparency in national gold reserves, there is no need to delay your financial future. Bullionstar provides a trouble -free connection between the digital and physical kingdoms of audio money, enabling clients effortless to exchange cryptocurrencies and physical gold with only a few clicks.

This flexibility has proven to be incredibly valuable to our forward -thinking clients. In recent months, several Bullionstar customers successfully uncovered their exposure by converting Bitcoin on the USD 100,000+ level to physical gold before the significant crypto strike -a decision that significantly preserved and improved their wealth.

This real world example highlights the practical benefits of having effective paths between different types of sound money. Whether you are aiming to diversify cryptocurrency gains, build a foundation for physical gold savings or just minimize exposure to Fiat currency risks, Bullionstar offers the safe infrastructure and expertise to implement your strategy effectively.

Explore our website today to find out how our transparent, fully allocated storage solutions and cryptocurrency exchange services can help you navigate today’s complex monetary landscape.