Key Takeaways:

-

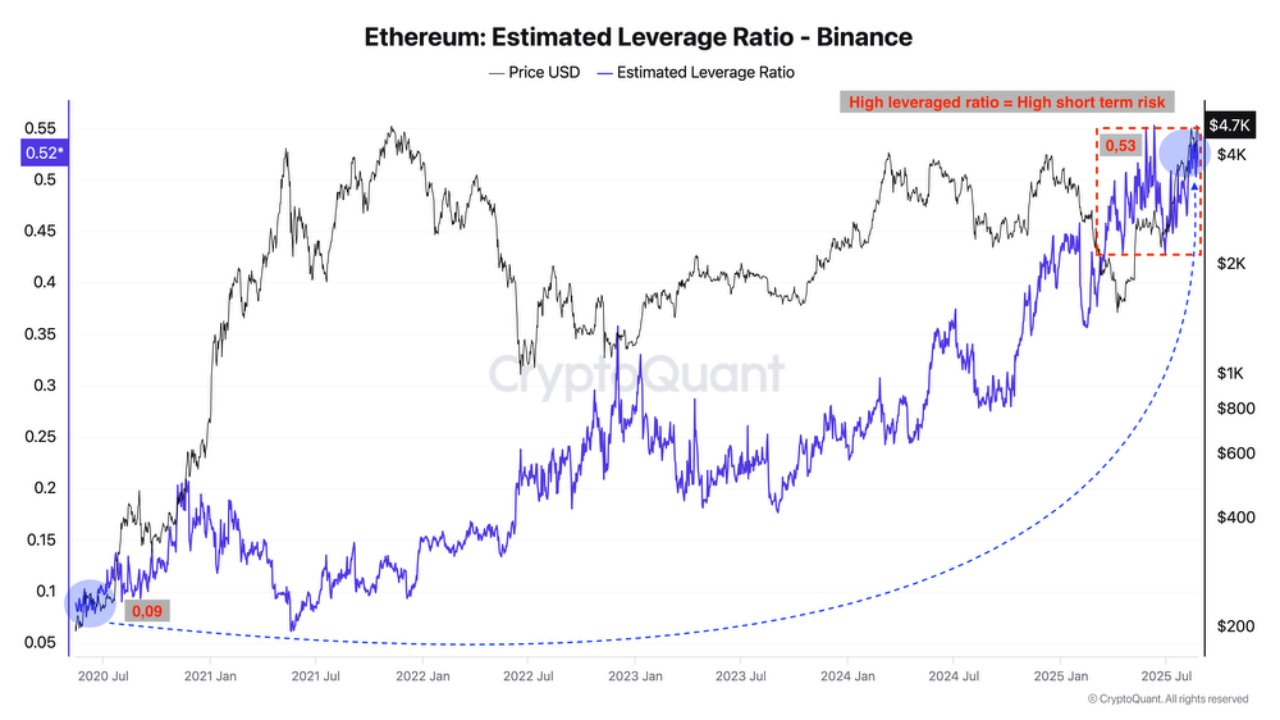

Ether gathered 5% after a “Monday trap”, but the gear risk increases with Binance’s ELR at record highs.

-

1.65 billion dollars in stableecoin flow and 208,000 ETH strikes show strong accumulation.

-

ETH that holds $ 4,700 keeps the door open for $ 5,000 while losing it risk a sharper correction.

Ether (ETH) shows resistance to Bitcoin (BTC) after shaking the latest “Monday trap”, a recurring pattern where geared longs face steep liquidations at the beginning of the week. While ETH summoned as much as 5% on Tuesday, BTC’s return has only been limited to 1%.

Data reveals that Monday consistently recorded the highest long liquidation, with spikes peaking 300,000 ETH during April and June’s features. The pattern emphasizes how weekend optimism flips in loss when liquidity returns early in the week.

Despite the recovery, ETH’s derivatives signal landscape signals overheated. Binance’s estimated leverage conditions (ELR) on ETH have risen to a record 0.53, up dramatically from only 0.09 by mid -2020.

Elr tracks the relationship between open interest in exchange reserves and offers a meter of how strong traders use leverage. Higher values suggest excessive optimism and a greater risk of forced liquidation.

With ETH Open interest, which strikes a new height of $ 70 billion on August 22, signalizes such extremes short -term risk, as excessive positions often precede sharp degradation events that flush the traders before the next leg higher.

Still, the place paints a contrasting image of strength. Crypto analyst Amr Taha points out that Binance exhibited over $ 1.65 billion in stablecoin deposits this month, marking the other such increase over $ 1.5 billion in August.

These influxes signalize fresh liquidity that prepares to enter the market. Meanwhile, Ether Binance Eths made up nearly 208,000 ETH, ie. $ 1 billion, across 24 to 25 August, suggesting investors are moving assets to cold storage, reducing sales of sales and amplifying long-term bulish positioning.

The combination of rising leverage and institutional accumulation leaves ETH at a crossroads. While liquidity inflow and exchange outflow tilt Bullish, extreme leverage increases the risk of short -term volatility.

Related: Sharplink added $ 252M ETH last week, $ 200m warcraft back

Ether bulls need to recover $ 4,700 to regain control

Ether gathered strongly on Tuesday and climbed to $ 4,579 after absorbing liquidity from a daily order block and gene test on long -term support for $ 4,350. Momentum on lower time frames remains constructive, but sustainability is the key to continuation.

On the mid-term card, Price action is currently filling a bearish fair value between $ 4,600 and $ 4,450, with risk of expansion to the level of $ 4,000 if the sale of pressure persists.

In order for this hole to be invalid, ETH must regain prior low level near $ 4,662 and secure a decisive daily close over $ 4,700. Such a movement would adapt both lower and higher time frame structures, restore bullish momentum and open the path towards $ 5,000.

Conversely, sustained consolidation under $ 4,700 suggests that the rally is primarily powered by short coverage, with shorts closing their positions generating a temporary pressure upwards, while sellers seek to return to higher levels to operate the price lower.

Failure to recover $ 4,700 keeps eth locked in a crucial range between $ 4,700 and $ 4,350, with a break below $ 4,350, which is likely to trigger a deeper correction in line with seasonal impact and a potential market structure change.

Until then, $ 4,700 remains the turn that separates a correction from a renewed bullish leg.

Related: Price Provisions 8/25: SPX, DXY, BTC, ETH, XRP, BNB, SOL, DOGE, ADA, LINK

This article does not contain investment advice or recommendations. Each investment and trade movement involves risk, and readers should make their own research when making a decision.