US investment manager Guggenheim is expanding his digital commercial papers through a partnership with Ripple that emphasizes the growing convergence between traditional funding and crypto-native businesses.

According to the partnership, Guggenheim’s subsidiary, Guggenheim Treasury Services, will make its US state-sponsored permanent income available on the XRP headbox, according to Bloomberg. Ripple will invest $ 10 million in the asset as part of the collaboration.

The commercial paper product is fully supported by US Treasury with customized maturity options of up to 397 days.

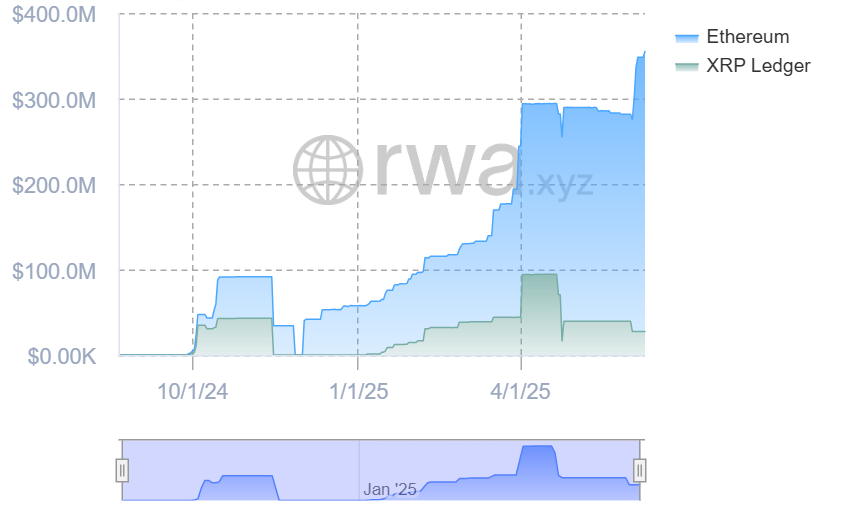

Ripplex-Overvarting Markus Infanger told Bloomberg that the product could also be made available for purchases using Ripple’s US Dollar Pegged StableCecoin, RLUSD. Since launching in December, RLUSD’s circulating supply has surpassed $ 350 million.

The Ripple Partnership is not Guggenheim’s first step into the cryptocurrency sector. As previously reported by CointeleGraph, Guggenheim Tokenheim Tokenr tucked his commercial papers of $ 20 million at Ethereum Blockchain in September 2024.

Related: Dubai Regulator Greenlights Ripple’s RLUSD STABRECOIN

Wall Street Eyes Rwa -Tokenization

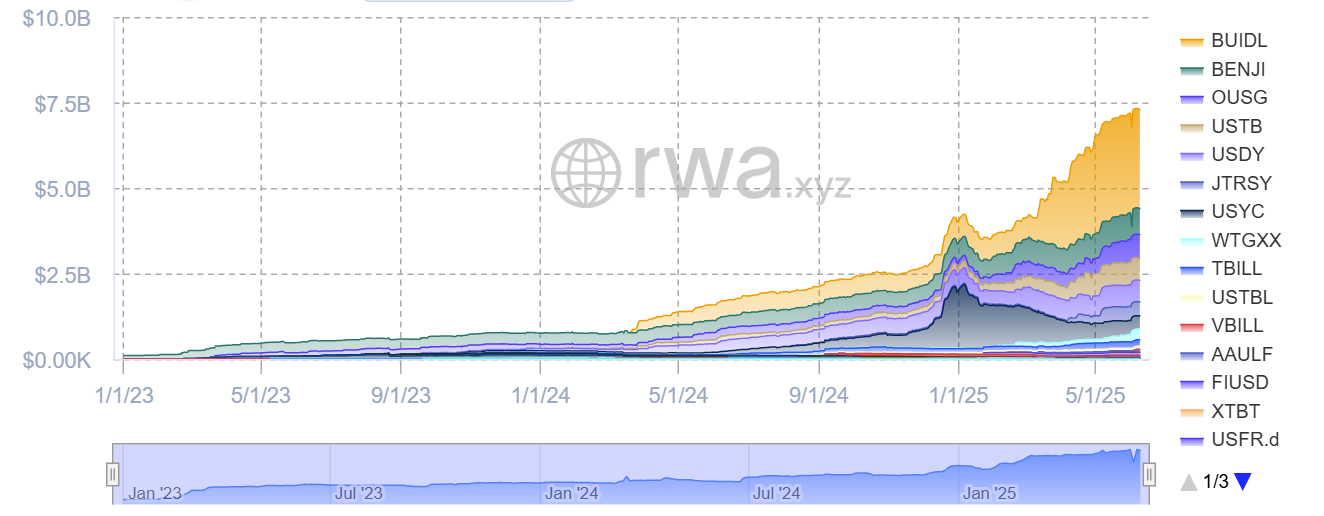

Tokenization quickly wins speed on Wall Street as leading financial institutions recognize the benefits of enabling assets in the real world (RWAs) to be traded onchain.

Among the most notable trends are tokenization of money market funds, exemplified by Blackrock’s USD Institutional Digital Liquidity Fund (Buidl), Franklin Templetons Onchain US Government Money Fund and Fidelity’s Tokenized US Dollar Money Market Fund.

Crypto-native companies are also expanding access to tokenized assets for a wider investor base.

As Cointelegraph reported, the German tokenization protocol Midas recently launched a tokenized Treasury on Algorand Blockchain. Unlike Buidl, which requires a minimum investment of $ 5 million, Midas’ product has no investment minimum, making it available to more investors.

Meanwhile, blockchain-focused venture company Jump Crypto recently made a non-revealed investment in Securitize, the tokenization platform behind Blackrocks Buidl.

Securitize has collected more than $ 4 billion in onchain assets, with Buidl accounting for almost $ 3 billion.

Related: Blackrock ‘Buidl’ Tokenized Fund triple in 3 weeks as Bitcoin -Boder