Key points:

-

Bitcoin is trading within a narrowing area between $ 103,500 and $ 108,800 over the past six days.

-

BTC Price must establish $ 107,000 as new support to continue the Uptrend.

-

Liquidity piece on both sides of the spot price suggests that the Bitcoin price could break out in both directions.

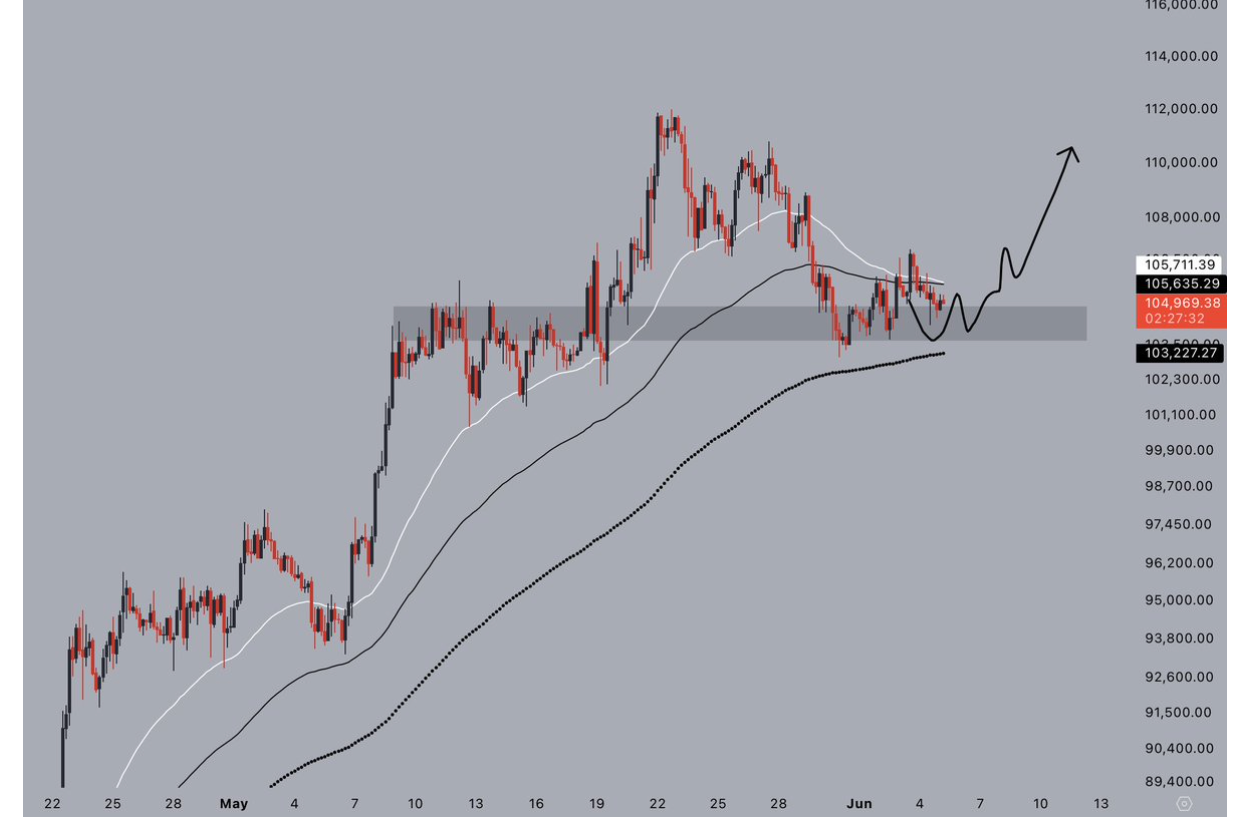

Bitcoin (BTC) price has been consolidated within a tightening of $ 103,500- $ 106,800 row since May 30. According to technical and liquidity data, Bitcoin’s consolidation can continue for a few more days unless the key levels are broken.

Bitcoin -Price must regain $ 107,000 to break out

According to a popular crypto analyst, Bitcoin can continue to consolidate in its current range slightly longer, especially if the resistance of $ 107,000 is not broken.

“This is why this level is so important to Bitcoin,” said MN Capital founder Michael van de Pop in a post on June 4 at X.

Related: Bitcoin Bulls ‘biggest threat is 2-month Tarift Ultimatums’ trap: analyst

He referred to the resistance over $ 107,000, uncovering Bitcoin’s latest improvement. According to Van De Poppe, it is obliged to overcome this barrier to initiate a fresh rally at new high times.

“There is no breakout about it yet, but if that happens, we are completely against a new ATH and $ 3,000 per $ eth.”

Scholarships Jelle said Bitcoin’s current consolidation cycle could continue for a few more days until the price goes over $ 105,000, with the 50-day simple sliding average currently in the four-hour time frame.

“Bitcoin still compresses between the EMAs at the top of local support,” said the analyst in their latest analysis of X, highlighting the most important support for $ 103,000.

“Give me a few more days with Chop, run all insanity, and then we send it higher again.”

“With tax catalysts that continue to tilt macro conditions to BTC’s benefit, any up-breakout could carry us past all times,” said QCP Capital.

In a June 5 -Telgrampost, the investment company said:

“Some institutional flows appear to agree. The demand for September 130K BTC calls is percholic, suggesting to grow conviction behind a bullish breakout narrative.”

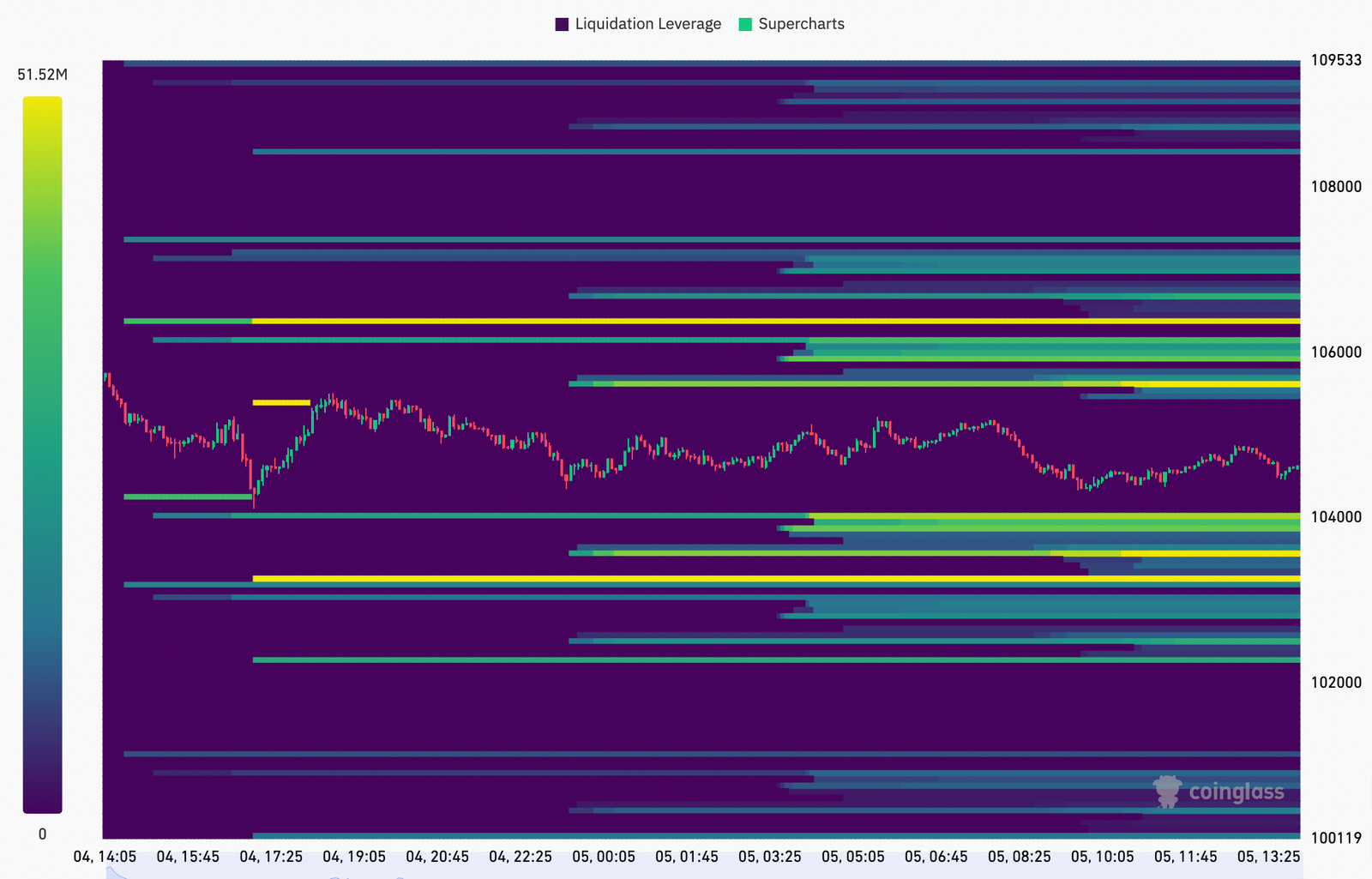

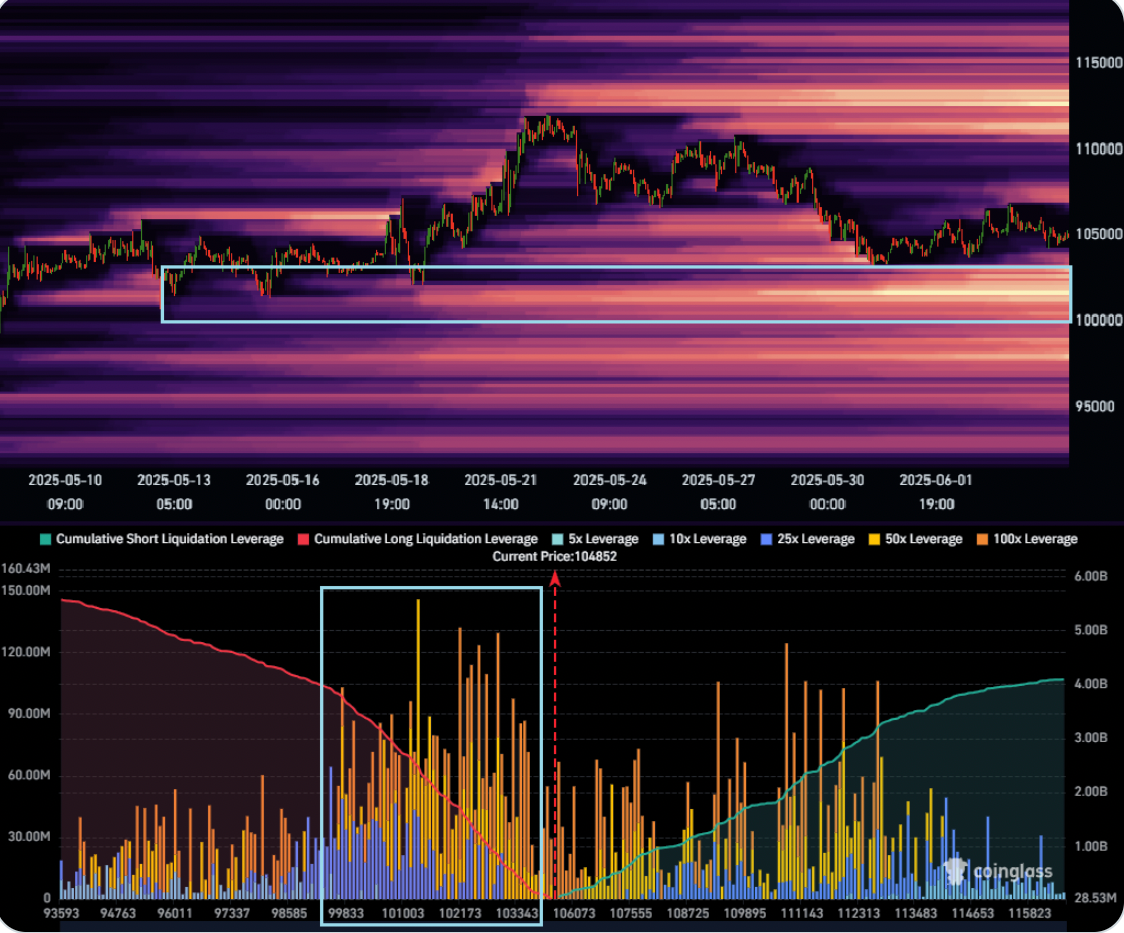

BTC seems to end the liquidity TUG-of-War

Data from monitoring of resource coinglass showed liquidity pieces on both sides of the spot price, as shown on the chart below.

Dealers are therefore looking for a liquidity grip that can trigger a breakout in both directions from the current interval.

“If market manufacturers are looking for liquidity before another pushes higher, the cluster down to just under 100K is similar to the target,” said the popular Bitcoin analyst Alphabtc in a June 5 -post, which added:

“A coward of 100k and then we wait to see.”

Pseudonymous trader Columbus claims Bitcoin will fall to take liquidity about $ 100,000 before he goes higher.

In a June 5 -Post of X, the trader said:

“The alternative would be that the upward liquidity is first taken out and then downward liquidity afterwards, which would pull it all even longer.”

As Cointelegraph reported, Bitcoin couldn’t turn $ 106,000 the resistance to support earlier this week.

This article does not contain investment advice or recommendations. Each investment and trade movement involves risk, and readers should make their own research when making a decision.